The Federal Emergency Management Agency (FEMA) recently released the preliminary Flood Insurance Rate Maps (FIRMs) for the Seacoast. The maps are used to set flood insurance zone rates for property owners inside the affected area. Though the new maps are not finalized, the changes are significant for those currently residing in flood zones or those planning to build within flood zones. Below we describe the impact of the new flood zones on new and existing structures.

Single-family homes are covered through homeowners insurance. Most insurance policies cover various disasters, such as fire, theft, and liability. But a flood Insurance policy, while purchased through your insurance provider, is backed by the federal government through the National Flood Insurance Program (NFIP). Insurance is not meant to be a substitute for preventing damage. Property owners should try to perform any improvement that will reduce the risk of flood damage. However, despite the best of efforts, every coastal structure is still subject to some level of flood risk.

Flood insurance zone rates are determined based upon building occupancy, building type, flood zone, date of construction, elevation of the lowest floor or the lowest horizontal structural member of the lowest floor, enclosures below the lowest floor, and location of utilities and service equipment.

Insurance rates do not vary significantly for occupancy (single-family, two family, etc.), so we won’t discuss that here. The building type classification takes into account the number of floors, presence of a basement, first floor elevation and the enclosure of elements below it, and whether the structure is a manufactured home affixed to a permanent foundation.

Date of Construction matters as different requirements are in effect depending upon the date a structure was built. Homes built prior to 1974 are ‘grandfathered’ and are charged a flat rate based upon occupancy, building type, and flood zone. Buildings constructed after 1974 are rated based upon all of the factors. If a pre-1974 home is substantially improved (improvement exceeds 50% of market value), it will be rated as a post-1974 structure. If a pre-1974 home is significantly damaged to where 50% of home value was lost, it too will be rated post-1974 after the repairs are made. In both case, either damage over 50% or improvement over 50%, the entire structure will need to be brought into compliance with current NFIP requirements.

Flood zones, which have been updated through the most recent FIRMs are grouped into three categories. Zone V is in close proximity to the water. It can be subject to wave heights greater than 3-feet. Zone V has the highest flood insurance rates. Zone A is a coastal flood hazard area where wave heights do not exceed 3-feet. Zones B, C, and X are lumped together here as these three zones are all outside the 100-year floodplain.

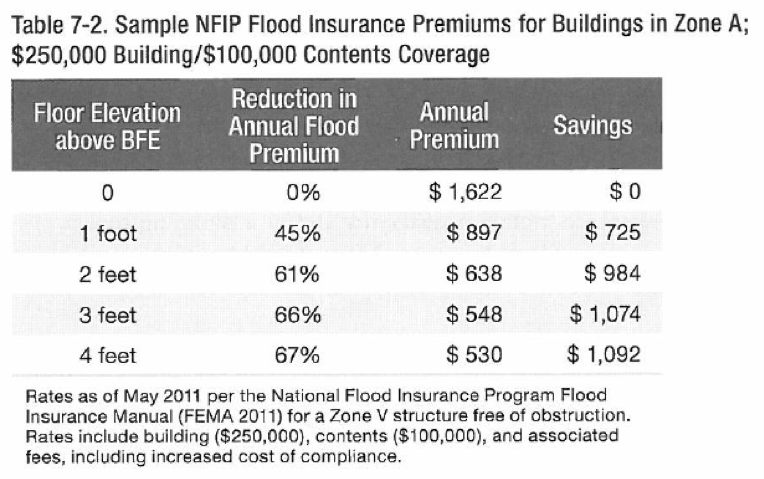

Zone A

The elevation of the lowest floor in relation to the Base Flood Elevation (BFE) sets the rating. Structures with a crawlspace or basement must have flood doors to allow for unimpeded flow of floodwaters greater than 1-ft in depth. If the openings do not provide enough area for the flow, the structure may be rated as having the lowest floor below the BFE. Mechanical systems and ductwork must be above the BFE or be designed to prevent water infiltration.

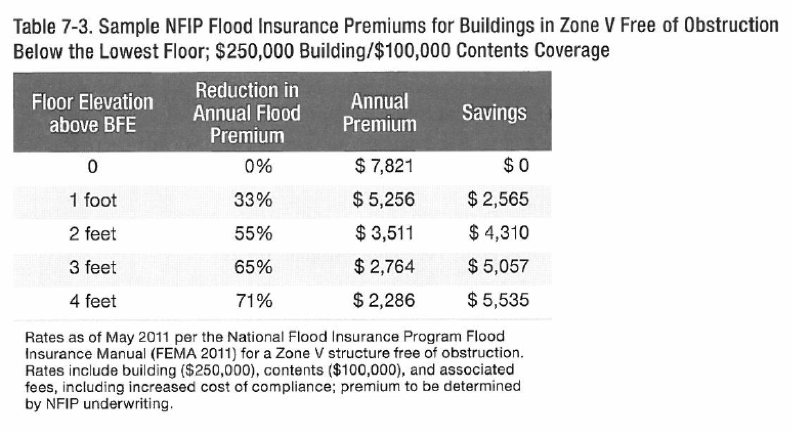

Zone V

Flood insurance rates for structures built on or after October 31, 1981 based upon the enclosure condition below the lowest floor. A ‘free of obstruction’ building is when there is no enclosure below the lowest floor other than open latticework or insect screening. A ‘with obstruction’ building has service equipment or utilities located below the lowest floor or if ‘breakaway walls’ enclose an area of 300-SF or less. Structures with ‘breakaway walls’ enclosing an area greater than 300-SF, or doesn’t have ‘breakaway walls’, or is finished below the lowest floor, must submit more information to the NFIP for a policy determination.

Buildings constructed in a ‘V’ Zone on or after October 31, 1981 have an additional rate table that differentiates between buildings with or without an obstruction below the elevated lowest floor.

Design professionals who specialize in coastal zone engineering can further reduce the risk of damage and achieve discount points that mean further reduced premiums. For example, these can be achieved by:

- Raising the lowest floor elevation

- Siting and environmental considerations

- Building support and design details

- Obstruction-free and enclosure construction considerations

- Distance from shoreline

- Presence of sand dunes

- Presence of erosion control devise or ongoing beach nourishment

- Foundation design based upon eroded grade elevation and local scour

- Foundation design based upon ASCE 7-10 loads and the 2011 Coastal Construction Manual

- Minimizing foundation bracing

- And many more

Owners and designers should consult with an insurance agent who specializes in flood insurance policies to see which items can pertain to their project.

Lastly, it should be noted that there is a difference as to what is allowed under floodplain management regulations and what is covered by NFIP flood insurance. Decisions should be made based on both floodplain management requirements AND by designs that reduce the flood damage risk (and premiums). To put it another way, meeting floodplain management requirements does not automatically translate into the lowest risk and lowest premiums. Consideration of further improvement factors, some listed above, can drive down premiums and the potential for damages.

Are you building in a flood zone? Learn more about why you should conduct a flood risk assessment before building.

Have questions? Contact Summit Engineering today.